Shrewsbury Ma Residential Tax Rate . Click here to view the fiscal 2024. Fiscal year 2024 tax rate information. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. 100 maple avenue shrewsbury, ma 01545. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax. Town hall hours of operation. Shrewsbury’s residential tax rate was $13.19 in 2021. The average single family home tax bill was $6,355. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. The values are as of january 1, 2023, based on sales from calendar year 2022. This website allows all users to search for properties by. The fiscal year 2024 tax rate is $12.38 per $1,000 of value;

from oliverreportsma.com

This website allows all users to search for properties by. Click here to view the fiscal 2024. The average single family home tax bill was $6,355. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. Fiscal year 2024 tax rate information. Shrewsbury’s residential tax rate was $13.19 in 2021. The values are as of january 1, 2023, based on sales from calendar year 2022. 100 maple avenue shrewsbury, ma 01545. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a.

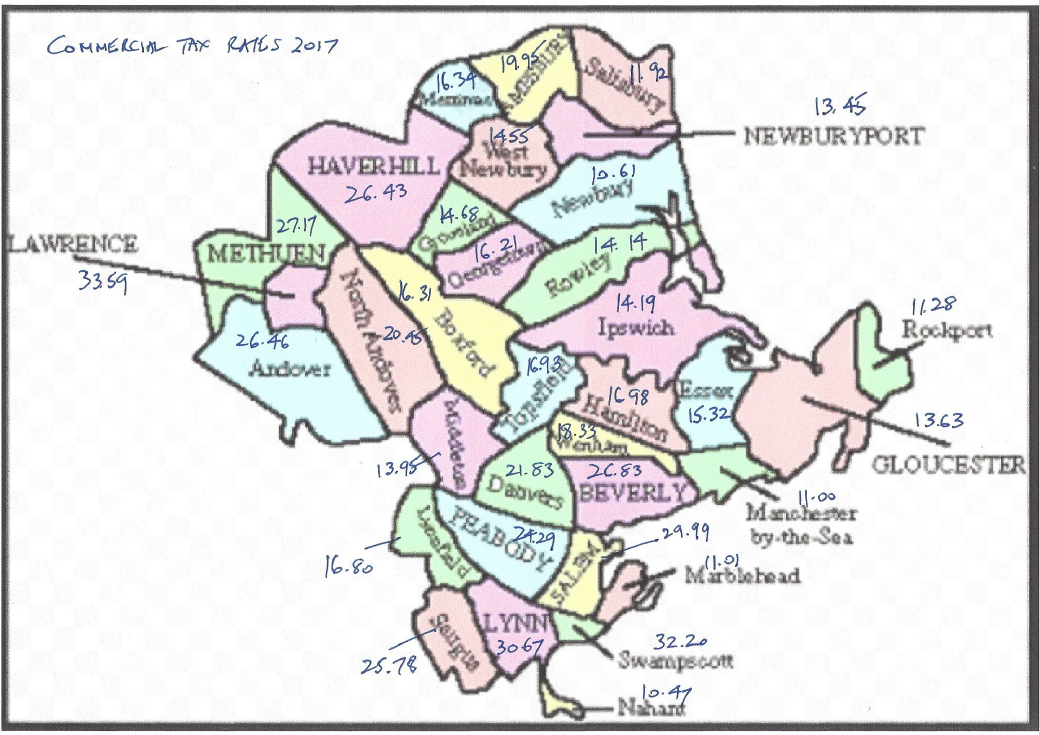

Commercial property tax rates wide variations in Essex County Oliver

Shrewsbury Ma Residential Tax Rate The average single family home tax bill was $6,355. Town hall hours of operation. The average single family home tax bill was $6,355. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. Shrewsbury’s residential tax rate was $13.19 in 2021. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; 100 maple avenue shrewsbury, ma 01545. The values are as of january 1, 2023, based on sales from calendar year 2022. Fiscal year 2024 tax rate information. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. Click here to view the fiscal 2024. This website allows all users to search for properties by. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Shrewsbury Ma Residential Tax Rate Shrewsbury’s residential tax rate was $13.19 in 2021. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. This website allows all users to search for properties by. Click here to view the fiscal 2024. Town hall hours of operation. The selectmen voted back in november to adopt a residential tax. Shrewsbury Ma Residential Tax Rate.

From johnpauloshea.ie

John Paul O' Shea Residential Zoned Land Tax Draft Map For Cork County Shrewsbury Ma Residential Tax Rate That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax. Town hall hours of operation. The average single family home tax bill was $6,355. The values are as of january 1,. Shrewsbury Ma Residential Tax Rate.

From www.etsy.com

Town of SHREWSBURY Massachusetts 1870 Map Etsy Shrewsbury Ma Residential Tax Rate The fiscal year 2024 tax rate is $12.38 per $1,000 of value; Click here to view the fiscal 2024. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. Shrewsbury’s residential tax rate was $13.19 in 2021. The selectmen voted back in november to adopt a residential tax rate of $14.11. Shrewsbury Ma Residential Tax Rate.

From pangeaanimation.blogspot.com

Massachusetts Estate Tax Rates Table Estate Tax Current Law 2026 Shrewsbury Ma Residential Tax Rate The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax. Shrewsbury’s residential tax rate was $13.19 in 2021. 100 maple avenue shrewsbury, ma 01545. This website allows all users to search. Shrewsbury Ma Residential Tax Rate.

From kelleher-sadowsky.com

Worcester Developer Buys Former Walgreens Site In Shrewsbury For 1M Shrewsbury Ma Residential Tax Rate Fiscal year 2024 tax rate information. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; The average single. Shrewsbury Ma Residential Tax Rate.

From www.shropshirestar.com

Tax bill rise for Shrewsbury residents Shropshire Star Shrewsbury Ma Residential Tax Rate This website allows all users to search for properties by. Town hall hours of operation. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax. The average single family home tax bill was $6,355. 100 maple avenue shrewsbury, ma 01545. Fiscal year 2024 tax rate information. Shrewsbury’s residential tax rate. Shrewsbury Ma Residential Tax Rate.

From www.freshstartmovingcrew.com

Living in and Moving to Shrewsbury, Massachusetts Shrewsbury Ma Residential Tax Rate This website allows all users to search for properties by. 100 maple avenue shrewsbury, ma 01545. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; Shrewsbury’s residential tax rate was $13.19 in 2021. Town hall hours of operation. The values are as of january 1, 2023, based on sales from calendar year 2022. In shrewsbury, approximately 52%. Shrewsbury Ma Residential Tax Rate.

From patch.com

Shrewsbury Tax Bills Comparatively Low Shrewsbury, MA Patch Shrewsbury Ma Residential Tax Rate The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. The average single family home tax bill was $6,355. Shrewsbury’s residential tax rate was $13.19 in 2021. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; In shrewsbury, approximately 52% of the revenue needed to run the government. Shrewsbury Ma Residential Tax Rate.

From shrewsburyma.gov

Taxes Shrewsbury, MA Shrewsbury Ma Residential Tax Rate 100 maple avenue shrewsbury, ma 01545. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. This website allows all users to search for properties by. Click here to view the fiscal 2024. Fiscal year 2024 tax rate information. The average single family home tax bill was $6,355. In shrewsbury, approximately. Shrewsbury Ma Residential Tax Rate.

From patch.com

2022 Residential, Commercial Property Tax Rates MA Cities, Towns Shrewsbury Ma Residential Tax Rate The average single family home tax bill was $6,355. Shrewsbury’s residential tax rate was $13.19 in 2021. Click here to view the fiscal 2024. 100 maple avenue shrewsbury, ma 01545. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. In shrewsbury, approximately 52% of the revenue needed to run the. Shrewsbury Ma Residential Tax Rate.

From www.cornwallseawaynews.com

Council puts forward 3.97 percent residential tax rate Shrewsbury Ma Residential Tax Rate Fiscal year 2024 tax rate information. Shrewsbury’s residential tax rate was $13.19 in 2021. The values are as of january 1, 2023, based on sales from calendar year 2022. This website allows all users to search for properties by. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; That’s according to principal assessor ruth anderson, who presented. Shrewsbury Ma Residential Tax Rate.

From warwickonline.com

Polisena’s first proposed town budget cuts residential property tax Shrewsbury Ma Residential Tax Rate Town hall hours of operation. Click here to view the fiscal 2024. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. The values are as of january 1, 2023, based on. Shrewsbury Ma Residential Tax Rate.

From anetqrebbecca.pages.dev

When Are Taxes Due 2024 Massachusetts Vina Delcine Shrewsbury Ma Residential Tax Rate Click here to view the fiscal 2024. Fiscal year 2024 tax rate information. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. 100 maple avenue shrewsbury, ma 01545. Shrewsbury’s residential tax rate was $13.19 in 2021. This website allows all users to search for properties by. The fiscal year 2024. Shrewsbury Ma Residential Tax Rate.

From jeronleedivision.com

Property Tax Jeron Lee Division Shrewsbury Ma Residential Tax Rate The average single family home tax bill was $6,355. This website allows all users to search for properties by. 100 maple avenue shrewsbury, ma 01545. Town hall hours of operation. The values are as of january 1, 2023, based on sales from calendar year 2022. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the. Shrewsbury Ma Residential Tax Rate.

From www.hingham-ma.gov

Frequently Asked Questions Hingham, MA Shrewsbury Ma Residential Tax Rate Click here to view the fiscal 2024. This website allows all users to search for properties by. The average single family home tax bill was $6,355. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. The fiscal year 2024 tax rate is $12.38 per $1,000 of value; The values are. Shrewsbury Ma Residential Tax Rate.

From oliverreportsma.com

Commercial property tax rates wide variations in Essex County Oliver Shrewsbury Ma Residential Tax Rate The average single family home tax bill was $6,355. 100 maple avenue shrewsbury, ma 01545. This website allows all users to search for properties by. Fiscal year 2024 tax rate information. The values are as of january 1, 2023, based on sales from calendar year 2022. The selectmen voted back in november to adopt a residential tax rate of $14.11. Shrewsbury Ma Residential Tax Rate.

From www.neighborhoodscout.com

Shrewsbury, MA, 01545 Crime Rates and Crime Statistics NeighborhoodScout Shrewsbury Ma Residential Tax Rate Fiscal year 2024 tax rate information. Click here to view the fiscal 2024. The values are as of january 1, 2023, based on sales from calendar year 2022. The selectmen voted back in november to adopt a residential tax rate of $14.11 for the 2022 fiscal year. This website allows all users to search for properties by. That’s according to. Shrewsbury Ma Residential Tax Rate.

From www.digitalcommonwealth.org

A map of the Town of Shrewsbury, Mass Digital Commonwealth Shrewsbury Ma Residential Tax Rate Shrewsbury’s residential tax rate was $13.19 in 2021. That’s according to principal assessor ruth anderson, who presented the proposed tax rate to the select board during a. In shrewsbury, approximately 52% of the revenue needed to run the government and schools is derived from the property tax. Click here to view the fiscal 2024. Fiscal year 2024 tax rate information.. Shrewsbury Ma Residential Tax Rate.